NALA Money, a Tanzania-based fintech startup, has teamed up with Cellulant, a Pan-African Payments Company, to power remittance payments from the United Kingdom and the United States into Kenya, Uganda, Rwanda, Tanzania, and Ghana. The partnership between Cellulant and NALA will also aim significantly reduce the cost of sending money according to both companies.

Research shows that apart from Official Direct Assistance (ODA), remittances make up the second-largest source of external resources for regions of Afrika south of the Sahara desert.

"Today, Sub-Saharan Africa is the most expensive region to transfer money into. In Tanzania and across the African continent, there is a huge opportunity to harness technology to reduce payment fees and build next-generation payment and banking products. At NALA, we've built a completely digital platform for individuals and businesses based in the UK and US to send money to their friends, family, and employees in Africa. Cellulant is one of the early payment pioneers on the continent, and we chose to partner with them because of their deep expertise in the space and their strong technical capabilities,” said Nicolai Eddy, Chief Operating Officer at NALA.

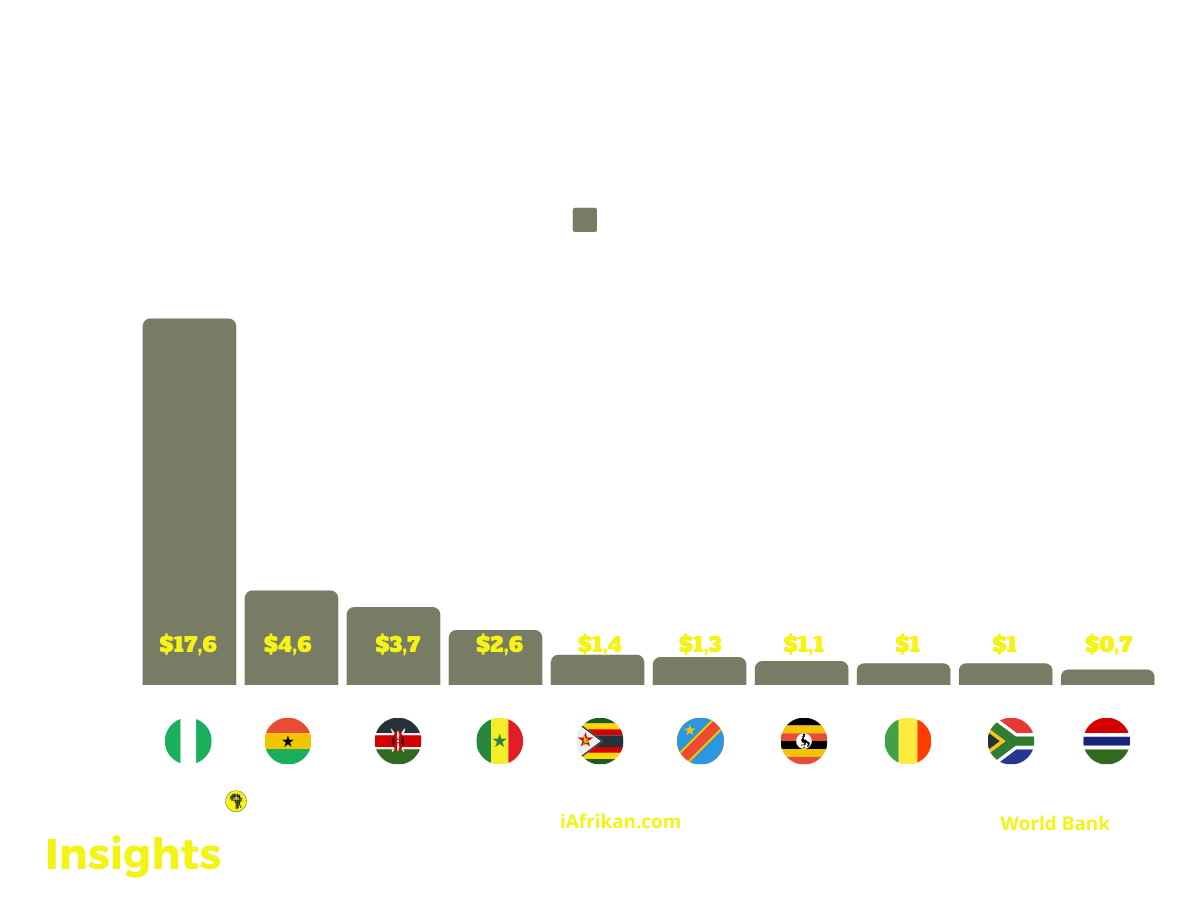

Remittances to Afrika

It goes without saying that the COVID-19 pandemic dealt many families in Afrika a blow as far as income goes. Whether it was the shutting down of companies or the loss of jobs, many families found themselves with less money to go around. Added to that, the cost of living has generally gone up across the continent.

As such, to supplement income, many families rely on relatives who live and work outside the continent or in other parts of the continent to send money home.

In 2019, approximately $48 billion was remitted in Afrika, with Nigeria receiving roughly 50% of this amount, followed by Ghana and Kenya. Despite a decline in remittance inflows in sub-saharan Afrika in 2020 due to the COVID-19 Pandemic, countries such as Kenya and Ghana experienced an increase in cross-border payments.

Remittance inflows picked up again and grew roughly by 6% in 2021.

Reducing fees and enabling payments

Transaction fees absorb a large percentage of the billions sent to Afrika every year. The cost of sending money into Afrika is the highest worldwide. Tanzania and Kenya remain the highest with charges at 17% and 21% respectively for every $200 sent. With increased intra-Afrikan trade and between Afrika and the rest of the world, the transaction cost is one of the barriers to success in facilitating cross-border payments.

Both companies have said that they hope their partnership will reduce fees significantly.

"Cellulant solves a huge challenge for businesses coming into Africa since they have to deal with 54-55 different payment providers and multiple currencies, with at least one for each country. With our presence in 35 countries, we are able to cover all these needs through a Single platform, Single API, Single contract, One web tool and a Single point of managing all operations. This partnership complements Nala’s fully digital cross-border payment capabilities with the necessary infrastructure to enable them to deliver their services in the continent effectively,” said David Waithaka, Cellulant’s Chief Revenue Officer.

— By Tefo Mohapi