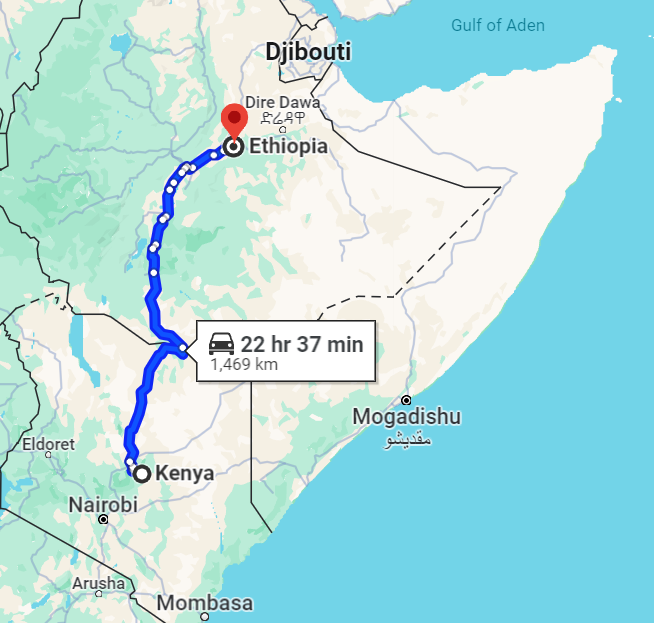

Safaricom's M-PESA, a mobile money service that has transformed financial transactions in Kenya, is venturing into Ethiopia, marking a significant step towards expanding its reach in the East African region. While M-PESA's launch in Ethiopia in August of the previous year has garnered attention, its growth trajectory in the country remains in its early stages.

Kenya's M-PESA: Leading the Mobile Money Revolution

In Kenya, M-PESA has indeed revolutionized financial inclusion, boasting a significant user base and dominating the mobile money market. With over 38.1 million mobile money subscriptions as of September 2023 and a staggering 96.5% market share, M-PESA has reshaped the financial landscape, particularly in rural and underserved areas.

However, despite its success, challenges persist. M-PESA's dominance has raised concerns about competition and market fairness, prompting regulatory scrutiny and calls for greater interoperability among mobile money providers. While initiatives like mobile money interoperability aim to promote competition, the reality is that M-PESA's market dominance remains largely unchallenged.

Additionally, recent service outages and a lack of transparency from Safaricom have highlighted vulnerabilities in M-PESA's infrastructure, raising questions about reliability and customer trust. These incidents represent a departure from M-PESA's reputation for reliability and customer-centricity, signaling potential areas for improvement.

Moreover, the issue of unregistered users in Kenya's M-PESA ecosystem poses significant challenges. While M-PESA initially allowed customers to send money to unregistered Safaricom users, concerns over security and untraceable transactions have prompted Safaricom to implement stricter regulations. The prevalence of unregistered users underscores the need for enhanced security measures and regulatory oversight to mitigate risks associated with illicit transactions.

Ethiopia's M-PESA: Navigating Challenges in a New Market

In Ethiopia, M-PESA's journey is still in its infancy. While Safaricom reports 3.1 million customers as of December 31, 2023, it's crucial to recognize the complexities of operating in a new market with unique regulatory and cultural dynamics. Ethiopia's population size presents a significant opportunity, but translating this potential into tangible growth requires navigating regulatory hurdles, building infrastructure, and gaining the trust of consumers.

Despite ambitions to replicate its Kenyan success, M-PESA faces stiff competition in Ethiopia, where other mobile money providers and traditional banking services are vying for market share. Moreover, Ethiopia's low levels of financial inclusion and limited digital infrastructure pose challenges to widespread adoption of mobile money services like M-PESA.

While the National Financial Inclusion Strategy in Ethiopia outlines ambitious goals for expanding financial access and digital payments, achieving these targets will require collaborative efforts from industry players, policymakers, and regulators. Safaricom's CEO, Peter Ndegwa, acknowledges the opportunity in Ethiopia but recognizes the complexities involved in realizing M-PESA's potential in the country.

Navigating the Path Ahead

As Safaricom's M-PESA expands from Kenya to Ethiopia, it faces both opportunities and challenges on its journey towards financial inclusion. While Kenya's M-PESA success story offers valuable insights, it's essential to approach Ethiopia's market with a nuanced understanding of its unique context and complexities.

By addressing regulatory concerns, enhancing infrastructure, and prioritizing customer trust and transparency, M-PESA can navigate the path ahead and contribute to advancing financial inclusion in Ethiopia. However, success will require more than just ambition—it will necessitate collaboration, adaptability, and a genuine commitment to empowering individuals and communities through accessible and reliable financial services.